Credits : Noyz

At this year’s Fragrance Innovation Summit in Paris, Cosmetics Inspiration & Creation explored a crucial question: why is fragrance undergoing such a profound transformation, and what does this shift reveal about the future of beauty?

Our talk, “How Gen Z & Alpha Redefine Perfume and Its Use” unpacked the cultural, emotional, and behavioral shifts that are pushing fragrance far beyond its traditional codes.

Today, only 6% of 18-34 y.o. consumers do not wear perfume, compared to 26% of 55+ y.o. consumers (Circana - Fragrance Innovation Summit 2025). What emerges today is clear: younger generations are not just buying perfume, they are reinventing its meaning, its use, and its value.

Below are the three major transformation engines shaping the next era of fragrance.

1. Personal Layers - Fragrance as a Language of Identity

Rare Beauty - Fragrance Layering Balm

For Gen Z and Gen Alpha, fragrance is no longer a finishing touch. It has become a core tool of self-expression, a modular language through which they articulate their moods, aesthetics, and evolving identities.

This generation has abandoned the traditional “signature scent” in favor of fragrance wardrobes: flexible scent portfolios designed to shift with context, emotion, and persona. On TikTok communities like PerfumeTok or Smellmaxxing, perfume is framed as a daily emotional code: “What scent matches my mood today?”

This drive for personal authorship fuels a new wave of innovation focused on augmentation, modulation, and co-creation:

Rare Beauty introduced Fragrance Layering Balms, allowing users to build their own olfactive “score” by adding amber, floral, woody, or fresh layers. As Selena Gomez puts it, “I wanted a perfume that evolves with me.”

Glossier continues to push its “skin-scent” ethos with You Fleur, a fragrance designed to adapt differently to every wearer, encouraging layering as a personal signature.

New gestural formats are multiplying: gels, body & hair mists, mood mists, enabling users to adjust texture and intensity.

In Japan, IPSA’s Skin Fragrance Gels blur the line between scent and skincare for a more intimate, subtle expression.

Across markets, one shift stands out:

Fragrance is becoming a writable space, a canvas for identity, emotion, and self-narration.

2. Wellness Scents - The Rise of Emotional Fragrance

Orebella

As stress and emotional volatility rise, especially among younger consumers, fragrance is increasingly perceived as a tool for emotional regulation, clarity, and reconnection.

What was once a beauty gesture is transforming into a micro-ritual of psychological support. Nearly 80% of UK consumers now believe fragrance can improve mental well-being (Mintel - Make Sense of Scents - July 2025).

This shift fuels an emerging hybrid territory between perfumery, neuroscience, and self-care, illustrated by a new generation of functional, mood-responsive scents:

Moods, launched this year, reimagines aromatherapy through clinically validated blends. Its “MoodSwings” duo, a double roller designed for on-the-go regulation, delivers measurable emotional impact, with 76% of users reporting improved mood and harmony.

Orebella (by Bella Hadid) brings bi-phased scent rituals combining skincare actives, mushrooms, and aromatherapeutic components, turning fragrance into a meditative, sensorial practice.

The Nue Co uses neuroscience and nostalgia with First Milk, formulated to trigger the brain’s comfort response.

The multisensory trend expands through edible fragrances such as Amorecco, merging taste, touch, and scent.

Everyday beauty also shifts: Being Frenshe transforms lip wellness into a mood-boosting centering ritual through scent science.

What we witness here is a status shift:

Fragrance is evolving from aesthetic pleasure to emotional utility, a new form of self-soothing and regenerative care.

3. Cultural Anchors - Fragrance as a Cultural Dialogue

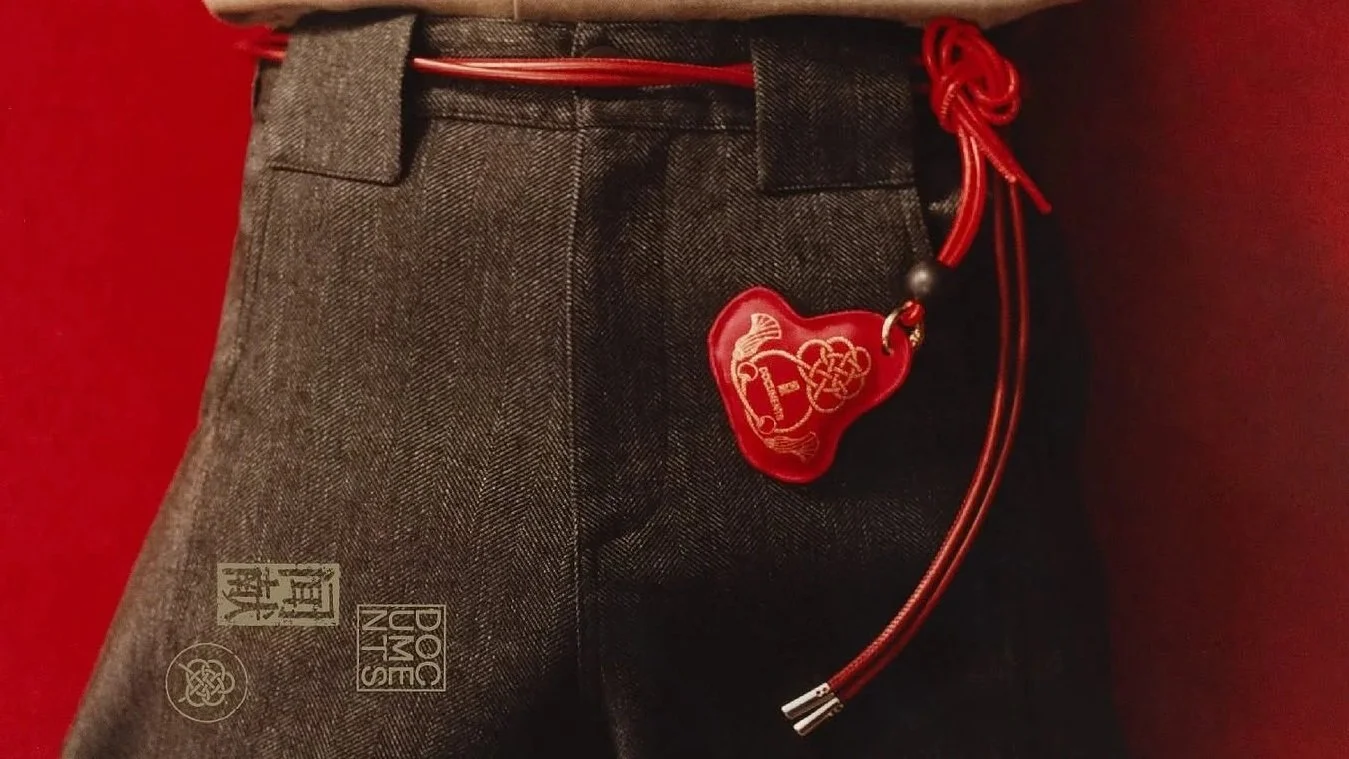

Documents

For Gen Z, identity is cultural as much as personal. Fragrance, therefore, becomes a medium of heritage, storytelling, and collective meaning.

Brands increasingly lean into culture, art, craft, history, symbolism, to create fragrances that resonate emotionally and intellectually:

In China, Documents blends Guochao cultural revival with modern perfumery. Products reinterpret traditional lucky charms, rituals, and olfactive philosophies, turning perfume into a living cultural artefact.

Miu Miu Miutine becomes a manifesto of “soft rebellion,” merging literature, youth culture, and feminine narratives into an olfactive attitude.

Diptyque curates its experiences like exhibitions, as seen in its Shanghai installation Un Air de Paris in October, an educational and immersive scent journey designed for younger audiences.

In Korea, Borntostandout pushes cultural hybridization to the extreme: Onggi clay pot maceration, gallery-like boutiques, and ultra-concentrated juices redefine fragrance as contemporary art.

Balenciaga’s revival of Le Dix shows how heritage can be reimagined for a new generation seeking roots, authenticity, and symbolism.

Across these initiatives lies a powerful insight:

Fragrance is becoming a cultural language, a place where identity, memory, aesthetics, and heritage meet.

The CIC Take - What This Transformation Means for the Future of Fragrance

Younger generations are rewriting the expectations of fragrance at every level.

They fluidly navigate between self-expression, emotional functionality, cultural meaning, and expect scent to evolve with them.

We are entering a new paradigm where fragrance becomes care and culture, performance and identity, a sensorial ecosystem rather than a single product.

For brands, the opportunity is bold and clear: Don’t just create new scents. Create new meanings, new rituals, and new ways for consumers to connect to themselves, to others, and to the world.

Check our website for our latest Trend Books, Inspiration Tours or Retail Forecasting Books. Don’t hesitate to contact us for a tailored Fragrance Report.